A colossal shift is happening in every sector– Accountants and lawyers need to open their minds or be eaten up

12 February 2018

Technology futurist Ian Khan advised professional advisors at the 2018 North America Leadership Conference that Internet powered technologies are driving massive changes in the business world and that professional firms with traditional business models need to shift their minds to work out where they fit into this new world and how they can add value.

"Your professions are under threat. Some of the victims of technology change will be professional firms with some closing down within the next decade."

Ian Khan, Futurist

Are we in a 'fourth industrial revolution'?

The professions are under huge pressure according to Ian Khan as new core technologies such as artificial intelligence (AI) and blockchain emerge and rip up the rule book of how things have always been done. Speaking at the 2018 North America Leadership Conference, Khan described the extent of change as signaling the start of the ‘fourth industrial revolution’.

Khan’s view that the 500 year old, traditionally stable accounting profession is ripe for massive disruption, is supported by a 22 January 2018 article in Forbes magazine that states:

“By 2020, accounting tasks but also tax, audits, payroll and banking, will be fully automated using AI based technologies which will disrupt the accounting industry in a way it never was for the last 500 years.”

Forbes

Indeed, Khan warned that AI could take over the majority of what accounting firms do. Vigilance and a shift in mind-set are critical, advised Khan:

“The first issue for accountants is that they need to recognize that a change is happening and open their minds. Your profession is under threat. Some of the victims will be accounting firms closing down in the next decade.”

Khan predicted that many will find it difficult to run their firms because another business is offering the same service more effectively or technology is taking over.

The changes in the profession appear to mirror what is happening in our daily lives as we often sleep walk through change. Khan explained that change and technology have crept up on us without us realizing. This translates in the workplace, according to Khan, to technology taking over aspects of our jobs that we would previously do manually: “We don’t realize how technology is taking over simple tasks in our lives because we don’t think about it every day.”

Survival should not be the name of the game

In Khan’s view, firms need to work out not just how to survive, but actually how they can thrive in the next 5, 10, 20 years by using technology effectively:

“I guarantee there will be even faster change in the next few years – don’t expect things to slow down! You have to get your act together and stay on top of technology driven changes.”

What is ‘digital transformation’?

In his presentation, Khan explained that digital transformation is, in simple terms, about how business is changing due to Internet powered technologies. Firms need to embrace digital technologies to change how their business works. It’s not just the impact on their own business which is critical however:

“Professional advisors need to understand the technology as the lives of your customers are being digitally transformed – You need to think about your broader role as a trusted advisor when it comes to change as your clients have trust in you that you can add value to their businesses.”

In Khan’s view, working out how they will move forward at the pace of innovation and fit into this digitally connected world of tomorrow is the major challenge facing lawyers and accountants.

So what the core technologies shaping the world of tomorrow?

Blockchain and cryptocurrencies

Khan demystified blockchain by explaining that it is a big part of the fourth industrial revolution (Industry 4.0) and is for example, the underlying technology of all cryptocurrencies such as Bitcoin. He also expressed his view that PWC would not be barred from auditing listed companies for two years in India (following the Satyam Computers Services scandal) if blockchain technologies had been in use.

Blockchain is essentially a technology framework that changes the way people exchange information. What makes it so different, according to Khan, is the way information is stored compared to a traditional database, with every transaction, every data entry or deletion that happens being captured. These are very positive developments from the perspective of data integrity and security, with data being permanent and not stored in one computer, but in thousands of computers around the world, preventing hackers from stealing and corrupting data.

While many have talked about Bitcoin being compared to the ‘tulip bulb mania’ of the 17th century, Khan was quick to point out that the benefits of the approximately 1,200 cryptocurrencies in digital circulation are due to their underlying blockchain core technology:

“It’s similar to going back to the bartering system, but using technology. It is faster, payments are in real time, your identity is kept secret and there is no middleman – and everybody has a global copy of the ledger.”

While none of these cryptocurrencies can completely replace traditional currency right now, the trust and transparency created by blockchain are key factors that will, Khan predicted, lead to blockchain based technologies such as Bitcoin gaining traction in different industries.

The big firms are all over blockchain

Khan added that the fact that all the Big Four firms have invested early in blockchain (e.g. by funding start-ups) is a big signal that this is something accounting and law firms (and their clients) need to keep a close eye on. PWC and KMPG have blockchain strategies and have even been accepting Bitcoin as payment for their services in some countries.

Furthermore, with 46% of Goldman Sachs’ 2000+ job openings last year being technology related, it is pretty clear what the big firms are focused on and that they are moving away from their traditional business models.

You may also be interested to read...

AI: A force for good or evil?

Another huge technology development predicted by Khan to cause much disruption, particularly in the accounting world, is AI: “It will take over risk analysis, with human errors being reduced as audits and tax record keeping become automated.”

Khan explained that the potential for use of AI in the accounting and legal sectors is huge, with AI being built into software products to make services faster, more accessible and more efficient. He also predicted that many services would become commoditized as a result.

Many of us, according to Khan, are already interacting with AI without realising it, whether we are on Facebook, Amazon or Netflix, with much of this first stage ‘Narrow AI’ phase actually being ‘predictive analytics’ rather than the more dystopian AI seen in sci-fi movies.

While confirming that AI technology “isn’t quite there yet”, Khan sees AI changing and even devastating some industries in the next 5-10 years once a computer becomes as smart as a human across the board and start to think like humans.

Traditional accounting and law firms are going to need to react and quickly, according to Khan, with the futurist warning that unless they do, they will become obsolete:

“Digital transformation will eat up many firms.”

Predictions for the future from Ian Khan, futurist

Workplace generational differences present internal threats

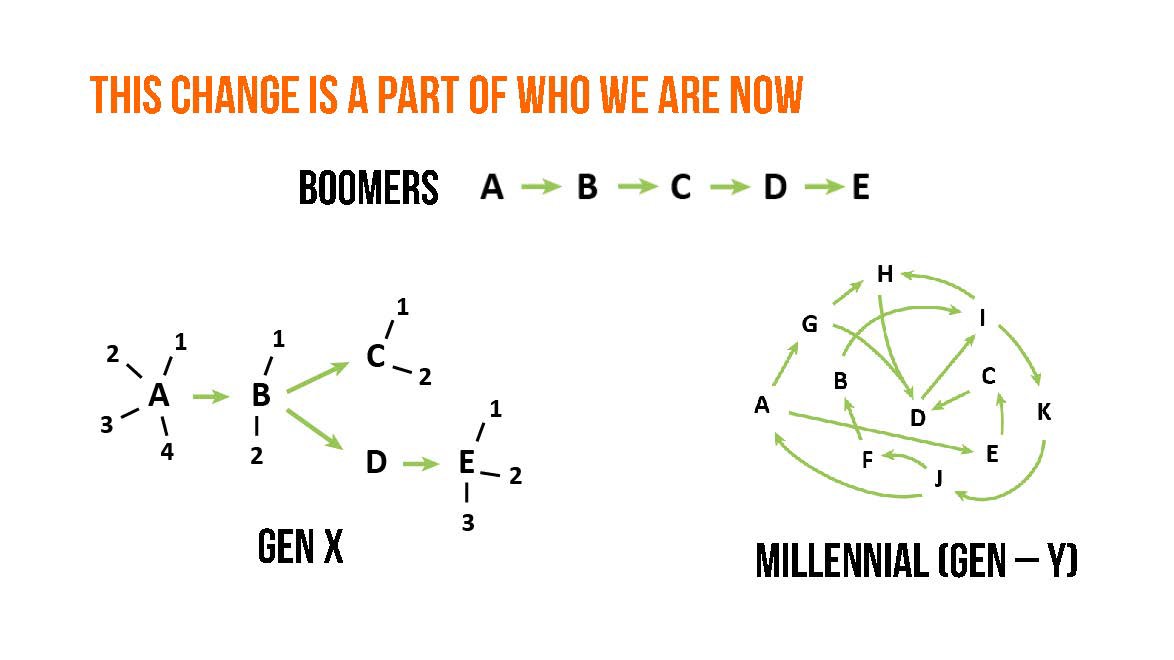

With different generations in our firms, who each have different ways of thinking, communicating and learning, Khan explained that the workplace is under threat internally as well as externally. Khan highlighted to many of the ‘Baby Boomer’ generation at the conference that while they may not understand how Millennials, Gen X and Gen Y colleagues work and may criticize their work ethic, short attention spans and levels of discipline, changes in the outside world are impacting who we are today:

The need to co-exist successfully in the firm environment

Khan commented that a huge volcano is erupting as many firms struggle to manage people as well as technology. He recommended that firms should reconsider how much focus they put on allowing their people to absorb new information and acquire new knowledge and should give them creative freedom to do things differently. There should, according to Khan, be a good balance between structured (classroom) learning and the unstructured learning preferred by many Millennials. Whether firms can adapt will determine their future, with Khan stating:

Firms need to harness the differences in the way different generations think, learn and communicate - NOW!

“The way we learn and think is changing our world - we risk losing clients unless we try to fit into our new environment.”

What can accounting and law firms do to keep up with the rate of change?

Khan urged attendees, as members of an ‘intelligent elite’, to shift their minds so that they are more tech savvy and able to communicate how technology affects business. He warned that moving at the speed of the slowest client would be the road to ruin for many firms:

“If you want to succeed, you have to understand the bigger picture. You can no longer just be in your industry – at your core you can be a law firm or accounting firm, but you need to pivot towards becoming a technology company or you will be overrun.”

Khan explained that while they can’t control all these external and internal changes, they can control how they react to them.

According to Khan, firms should be in ongoing dialogue with technology companies in their city so that they can see what it is coming and can collaborate. Moreover, forming a technology committee should be on the to-do list of every forward-looking firm.